The Envelope System On Steroids (Powerful Truth About Cash)

“We buy everything with cash” – said no successful CEO ever. Forget the envelope system. I’m talking about a system which all Fortune 500 companies understand. Money is money, no matter if we are talking business or personal finances. As a result, we should apply the same system Fortune 500 companies use to our personal finances to be as successful as they are.

“We buy everything with cash” – said no successful CEO ever. Forget the envelope system. I’m talking about a system which all Fortune 500 companies understand. Money is money, no matter if we are talking business or personal finances. As a result, we should apply the same system Fortune 500 companies use to our personal finances to be as successful as they are.

Cash Conversion Cycle, or CCC, is a major metric which senior management uses to understand how fast their company can convert cash on hand into even more cash on hand. Hence, the faster cash goes in and out through companies like Walmart and Apple, the higher their financial performance is.

Here is the twist: Since you and I, wagers slavers, can’t control when our paychecks are deposited and we don’t deal with accounts receivable and inventory turnovers, CCC works for us in the opposite way: We can’t control cash in, but we definitely can control and we should SLOW DOWN WHEN CASH GOES OUT.

Then, every successful company pay their bills in full on time, every time. It’s not a matter of not paying our bills, IT’S A MATTER OF HOW AND WHEN.

Let’s look at the formula to apply this system in our personal finances. But before we go there, let me give you some housecleaning items:

You Gotta Have A Budget

Successful companies have a budget. It’s not rocket science but extremely important in the century we live that you no longer have to leave the house or even pull out your wallet in order to spend money. If you have troubles with old-fashioned excel spreadsheets, here is a link for the best financial software for taming your budget.

You Gotta Have An Emergency fund

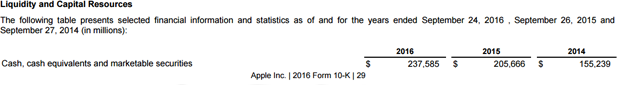

Look at the amount of cash this “little” company called Apple, Inc has. They sure know the importance of cash.

“That’s $237,585,000” rounded 🙂

To save more money, you have to automate and separate. Here is the WHY! and Here is the HOW!

You Cannot Outspend Your Income

Simple numbers that work – 50/20/30

50% of your income in essentials, 20% of your income into savings, and 30% of your income for you. Here is a more detailed view of what I mean.

You Must Pay Your Credit Card Balance On Time

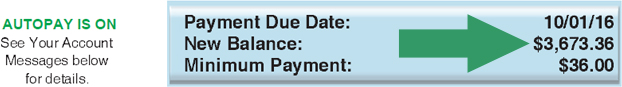

Sidekick: Don’t pay in full by making the credit card balance zero. Pay everything you owe from last month’s billing cycle. The mistake people make here is that they want to be clever and not owe anything at the end of the closing cycle of a credit card. Guess what? If you have nothing in there, a zero balance, nada, the credit card company might not report your credit card balance to the credit bureau and that won’t help your credit score for your future self.

Don’t pay more than what you need to pay. I’m not talking about the floor (minimum payment balance of $36). I am talking about the ceiling (last cycle’s FULL balance of $3,673.36). Again, I mean the amount you spent last month that it is now due.

“Yes, that’s from my credit card bill”

Got It? Let The Fun Begin

Isn’t it scary to believe people are marketed to lose their ability to think for themselves and to make their own critical thoughts? Then, a few years later we look stupid when we go apply for a mortgage and we don’t have a credit history because you’ve been paying everything with cash. Now it’s your turn to use the system in your favor and reap the benefits like businesses do. Check this out!

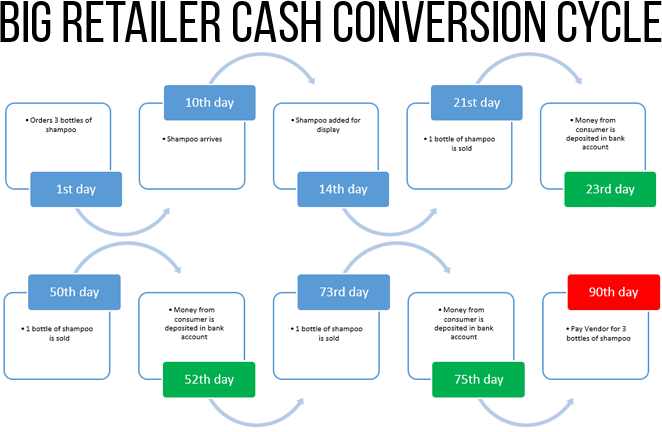

It takes this BIG RETAIL COMPANY (its name starts with a “W” for “win”) 2 days to collect our money we spend on groceries (green boxes)

However, it takes about 90 days for BIG W to pay its suppliers back for the merchandise they purchased (red box)

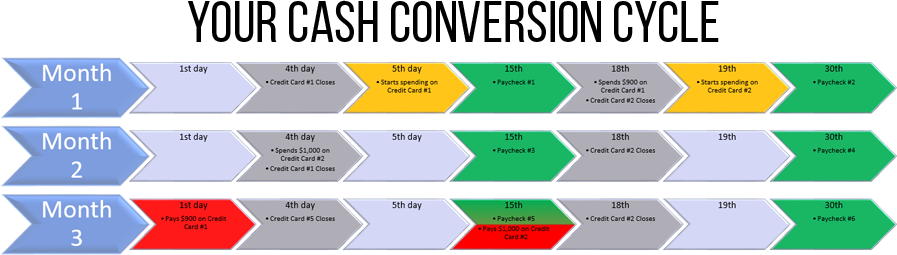

Now, look at this graphic.

If your paycheck is deposited on the 15th and the 30th of every month like most people’s paychecks do, cash was deposited in your bank account 4 times (green arrows) before you paid both credit cards (red arrows).

The GREY ARROWS represent the credit card closing cycle. Most credit cards close 3 days after payment due date.

The YELLOW ARROWS represent the day you start spending on each credit card.

Here are 5 Steps To Implement CCC in your finances in less than 30 days!

Step 1. Have (Open) 2 credit cards accounts

If you don’t have credit cards, apply for 2 cards. Whenever your account is set up, change the due dates to the 1st and the 15th of each month.

If you only have 1 credit card, first, change the due date to the furthest day away from your current due date. Let’s say today is the 14th. Change the due date to the 1st. Doing that, it will give you 1 1/2 billing cycles to buy you some time to implement the rest of the tips below. Then, in the meantime, apply to open a second credit card with the other payment due date of choice, in this scenario, the 15th.

If you already have 2 credit cards, change the payment due dates to the 1st and the 15th respectively.

Remember these dates:

From the 5th to the 18th, you spend with your Credit Card that is due on the 1st.

From the 19th to the 4th, you spend with you Credit Card that is due on the 15th.

Both of these due dates take into account around 42 days in between. That’s 42 days that you are going to reap the benefits of buying time.

Also, DO NOT FORGET!!!

- You have a budget and you stick with it.

- You pay the full balance that is due – the $3,673.36 from the picture above.

If you forget these 2 notions, the system is going to work against you.

Always Ask Yourself: What would a successful CEO do?

Step 2. Add up and split your budget into 2 categories

Split your monthly expenses into 2 categories: Fixed expenses and Variable expenses.

Fixed expenses are bills that you pay every month no matter what happens next. These include your cell phone bill, utilities, netflix, insurance (if you pay monthly), gym memberships, etc.

Variable expenses are the ones that you are going to spend every month but the total amount can vary. Fast food, groceries, restaurants, shopping, fuel, home supplies, and personal care are some examples.

After you categorized your personal expenses into these 2 categories, add them up and compare the total balance of each category. The goal is to be as close to a 50-50 split as you can.

If you can’t make that happen, it’s okay to mix these two categories but preferably, maintain as many fixed expenses together as possible.

Step 3. Pay Everything You Can With Your Credit Cards

This step is the bread and butter of this system. I really mean it! You are going to use the credit card cycle to pay for all of your bills and delay cash going out. This is how you can benefit and relate to the CASH CONVERSION CYCLE.

Remember the cool diagram I showed about the shampoo? BIG “W” never used their own cash to pay their bill. They used the cycle of the consumer’s money and the vendor’s merchandise to pay for what they bought (like you’ll be using the credit card company’s money!)

By now, you should have 2 credit cards and all of your monthly expenses separated into 2 categories with even, 50-50 total balances.

2 categories + 2 credit cards = You got it!

Pay each of these categories with respective credit cards. Always remember the due dates and the date you should spend on each card.

The dates mentioned above do 2 things for you: First, it helps to pace yourself on the variable expenses. Secondly, it will secure your hard earned cash inside your bank account for longer. Cash is only going out when you pay your credit cards on the 1st and 15th of each month.

Step 4. Direct Deposit Your Paycheck into a 2nd Savings Account

The perfect framework has to have a perfect place to work. Don’t confuse yourself with the type of the account. I called it my “Operating Savings Account”. This is where your money will flow in and out. Your paychecks are direct-deposited into this account and your credit cards are paid from this account.

You should have a TRUE savings account for big expenses and for an emergency fund. Remember, automate and separate!

I personally use Ally Bank – it has one of the highest interest rates and I love their customer service. Usually, in less than 5 minutes, I am talking to a real person on the other side of the phone.

This is not a monopoly, so you can use any online bank of your choice. Make sure they offer a competitive high interest rate for your hard earned cash. Here is a link for that!

The interest income you earn is calculated on a daily basis. So, the higher your daily balance in your Operating Savings Account and the longer your cash stays in that account, the better for you.

Leave your checking account for bills that cannot be added to credit cards like mortgage payments and for unusual cash expenses. Some venues out there still think we live in the 1950s and don’t accept credit cards as a form of payment.

You can fund your checking account monthly with a quick and easy online transfer from your Operating Savings Account.

Because rules are dumb, you are only given 6 transactions to move the money out of your Operating Savings Account. Don’t worry, you have plenty of moves to work within this framework.

1 move to pay your credit card due on the 1st.

1 move to pay your credit card due on the 15th.

1 move to fund your checking account.

and 3 extra moves to do whatever you want with.

CHECKMATE!!!

Step 5. Automate Everything!!!

I choose liberation over complication. You have better things to do with your time. This is what I do for a living and I don’t like to pay bills. It annoys me. So, I understand you. You, PT, his team, and I have valuable brainpower to use during the month and I hate to waste it worrying when bills are due. This is my least favorite question to hear:

“Did I pay this bill last month?”

You are liberating yourself to do things that you love and not having the risk to get a late fee added on top of all of your bills. Here is what you need to do:

First, talk to your employer and tell them you want to change your paycheck direct deposit account number. Give them the routing and the account number of your brand new “Operating Savings Account” created on Step 4.

Secondly, automate your credit card payments (1st and 15th of every month) that you created on step 1. Go into your credit card provider’s website and select auto-draft. Go through the steps they give you to add an account to pay your credit card bill.

Now, auto-draft everything you can from step 3. Go into your fixed monthly bills vendor’s website and choose auto payment as the option for payment. Add your credit card number and click okay. Most, if not all, vendors give auto payment as an option – it’s smart business. For them, to know you are going to pay on time and every time, it’s the cash conversion cycle at its finest.

CONGRATULATIONS!!! THERE YOU HAVE IT!!!.

YOU JUST PROMOTED YOUR PERSONAL FINANCES

TO A BUSINESS VENTURE!!!

For you and I and all of the businesses out there, CASH IS AN ASSET. It’s something you own that generates more money, more revenue. So, WE ARE ALL ASSET MANAGERS!!! If you own a company and one of your managers is doing a poor job managing your assets, wouldn’t you fire his butt right away?

If you followed these steps, you just implemented a framework where:

- You reap the benefits of cash back rewards in two credit cards,

- You truly understand where your money is going by splitting your monthly expenses into 2 categories,

- You are consciously spending between 2 credit cards depending on what day is today,

- You are speeding up the inflow of cash into your Operating Savings Account,

- You liberated yourself from the hassle of paying bills,

- You freed up more time for you to spend with your family, friends, and

- You have educated yourself on how money really works.

Don’t be afraid if you have the “Get-out-of-debt-pay-with-cash” mentality. You are paying everything you owe with cash – the only difference is WHEN! When the cash is going out of your bank account. You are paying all of your credit cards bills on time and all of that you owe every month if you follow the guidelines mentioned above.

This framework is implemented in all Fortune 500 companies. Do I have to remind you that they are the MOST successful companies on the PLANET?

Give your personal finances a business upgrade!

![Our Amazing [and Almost Free] Trip to Disneyland](https://ptmoney.wpenginepowered.com/wp-content/uploads/2016/03/free-disney.jpg)

Wow, great article. I am sharing this one.

Bookmarked the site too.

Thank you so much Mary. I’m just starting out with my entrepreneurial journey and it means so much to hear you say that you are going to share this one.

This is my “baby” lol I’ve been using this for my finances for a while now. Free money for nothing.

Let me know if you need help with anything else.

Happy Fatsgiving! 🙂

Excellent, in-depth advice! Very nicely put as well, easy to follow. I’ll make sure to put this into good use. Thanks!

I’m glad you liked Dominique. Let me know if I can assist you with anything. Happy Fatsgiving 🙂

Very interesting. Have been in several small businesses as a principal. We loved getting big contracts, but inevitably the bigger the contract, the slower the pay. Our solution was to balance our portfolio with small contracts that paid on time. That helped us pay our own bills as needed … but there were times when we had to resort to slow pay ourselves.

I agree. Balancing liquidity risk is one of the most common problems discussed by top management.

I’m glad you were able to manage cash flow. I hope the article gave you a little bit information on that.

Actually, I think you left out three zeros on the Apple calculation. It’s 237,585,000,000. Not a bad F-You position!

Cheers,

Biglaw Investor

Yes, good catch brother. Let’s say I was thinking on the thousands, not millions.

Yes, I believe Apple has one of the biggest cash positions out there.

When Apple bought Beats Electronics, do you know if they used all $3 billion in cash?